← Back

Mind & Match Blog

Introducing the Mind and Match Cost Estimate Tool

It's here! Here are some tips on how to use it.

Does trying to understand your mental health benefits make you feel like this?

Us, too. So we’ve been hard at work building out a tool to allow you to check your benefits and see your expected cost of working with a therapist of your choice — before you even contact them. And we’re so excited to be launching our cost estimate tool today! Here is some helpful information to guide you through using it. Jump down to see a video of the tool in action, or read through the detailed steps below. If you’re interested in taking a deeper dive into understanding your mental health benefits, follow our blog — we’ll be posting an in-depth affordability guide soon!

What you'll need

In order to check your plan benefits, we ask for your date of birth and member ID. The member ID can usually be found on the front of your health insurance card, and it may have both letters and numbers in it.

How to use the tool

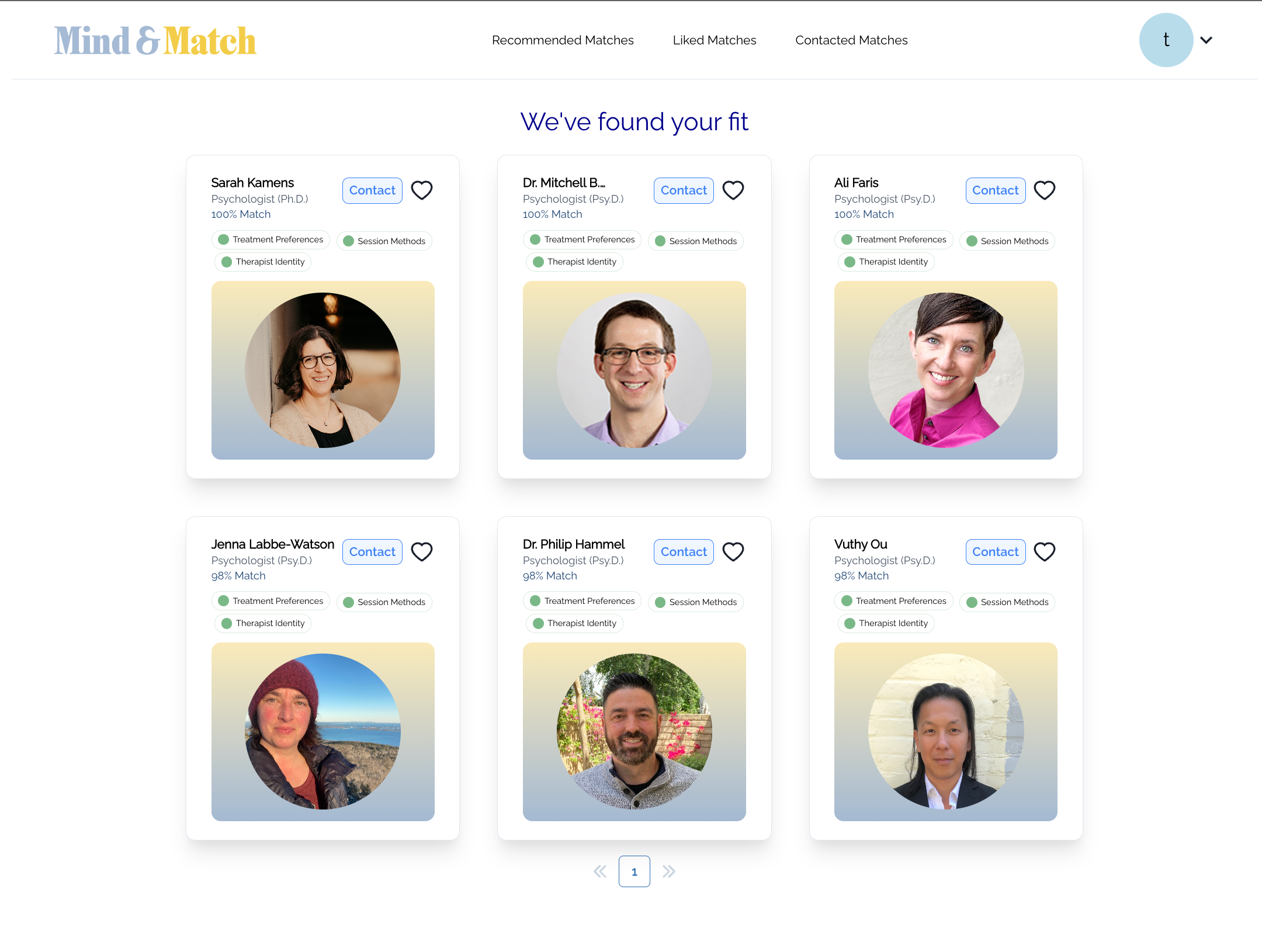

1. Start at your "Recommended Matches"

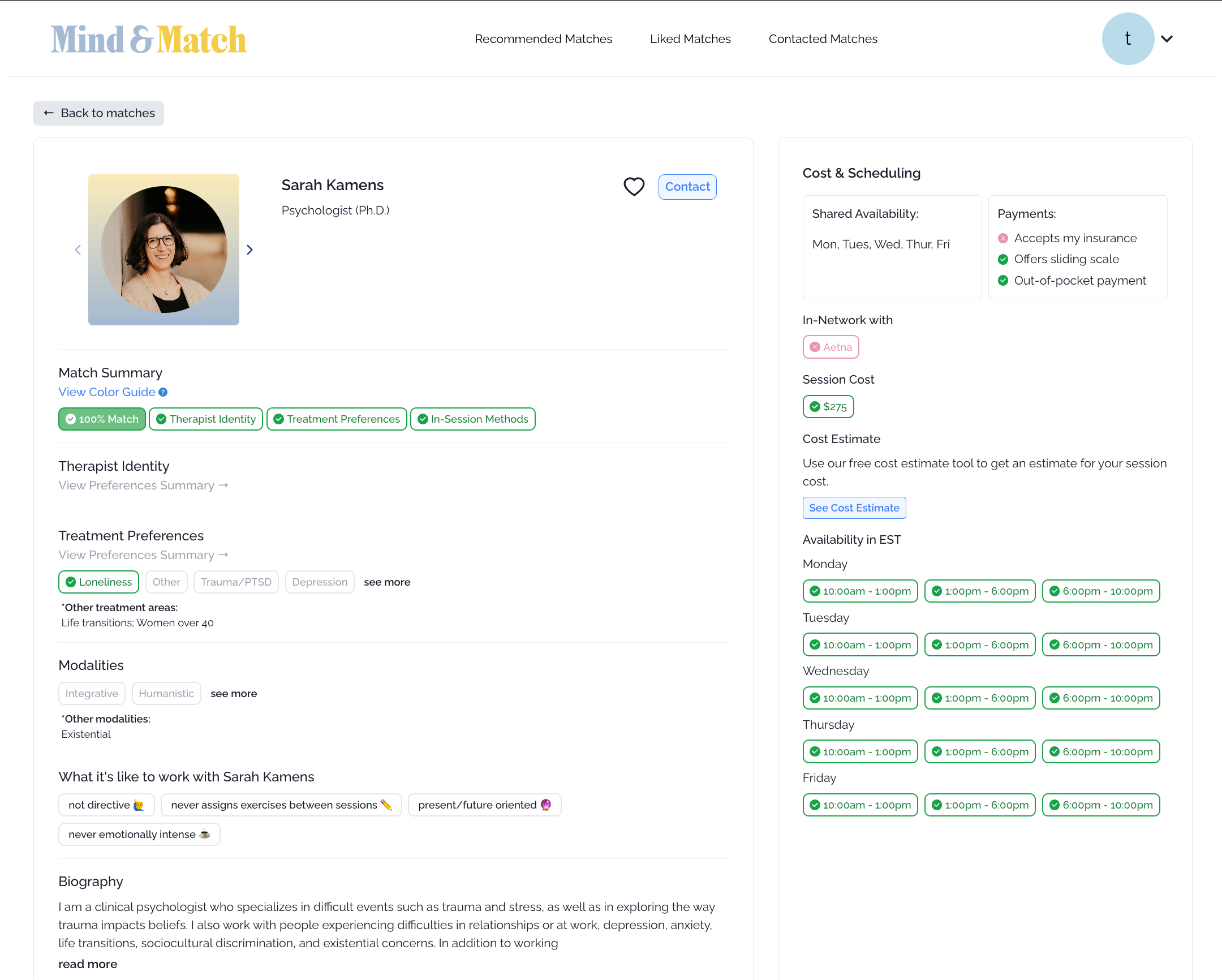

2. Click into a specific therapist's profile card to get a sense for whether they may be a good fit for you.

3. Once you've identified a therapist who may be a good match, click the "See Cost Estimate" button under the "Cost Estimate" section on the right panel.

4. You'll be prompted to enter your date of birth, insurance plan carrier, and plan ID if you haven't already added it to your account profile. This information will be saved to your account, so you'll only need to add it once!

5. You'll then see your cost by session results appear as a pop up

As a reminder, our tool provides cost estimates only. While we believe our cost estimates are generally accurate, we cannot guarantee that they are accurate. For exact costs, you must contact actual health care providers and your insurance provider.

Understanding your results

The first thing to check is the “Insurance Status” field at the top right of the card.

There are two main scenarios to understand: whether a provider is in-network or out-of-network

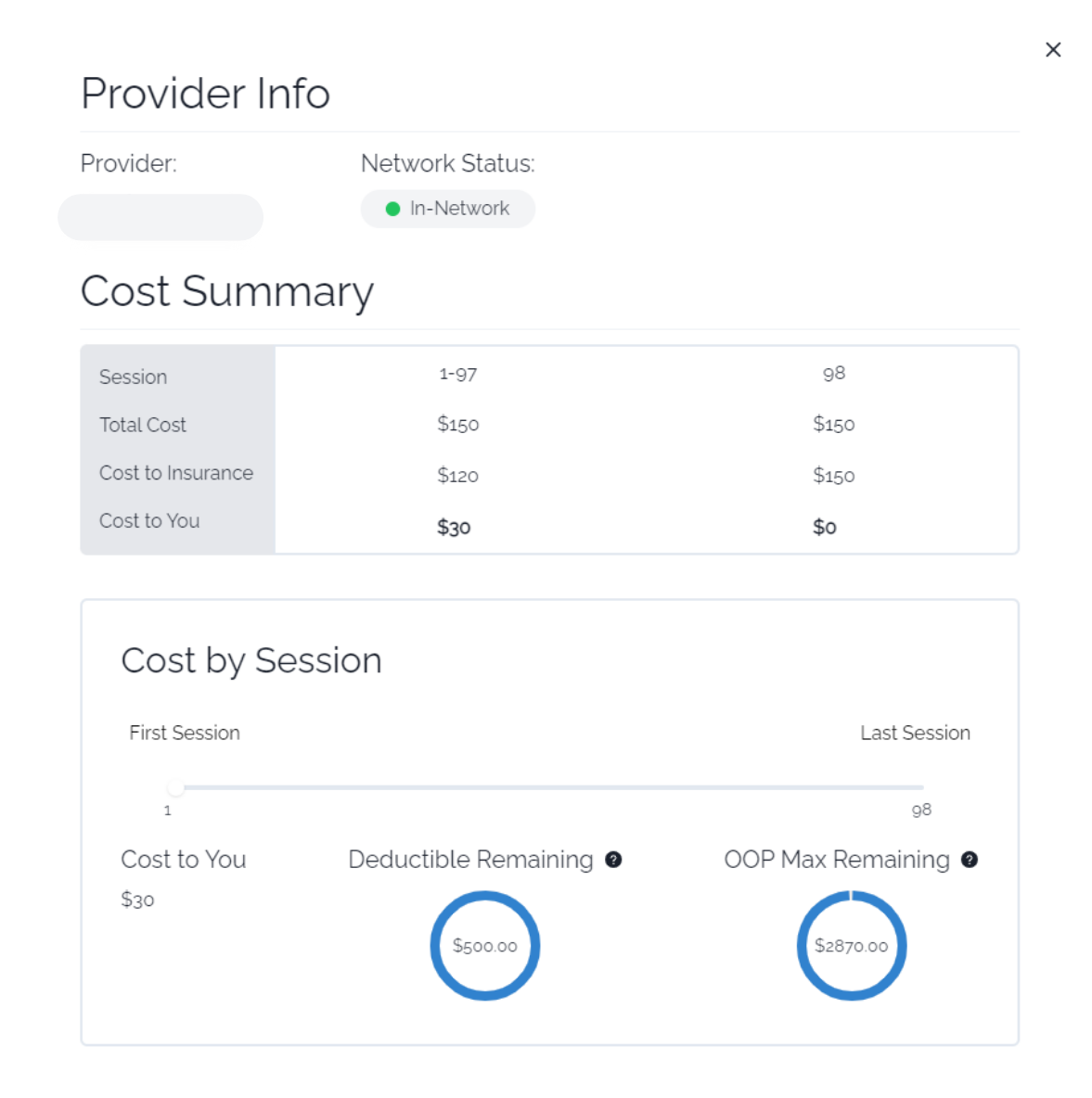

Insurance Status: In-Network

If a provider is in-network, that means they have contracted with your health insurance company to provide services to plan members at a set rate. On some plans, you may be responsible for the full cost of health services until you’ve reached your annual deductible. After you’ve hit your deductible, you may be responsible for a fixed payment per session, also known as a copay, at the time of service. The provider will then file a claim to your health insurance company to receive the remainder of the payment directly from your insurance (you’ll see this as “cost to insurance,” or the amount that your plan pays, on our tool). In this example, there does not appear to be a required deductible, since the “cost to insurance” line indicates some expected coverage as soon as the first session. The patient’s obligation remains constant at $30 per session for the first 97 sessions in this plan year.

Some plans will also have an out of pocket maximum (aka “OOP Max”), which is the total amount that you have paid out of pocket for covered services during your plan year. Your in-network, out-of-pocket limit puts a cap on your medical expenses. After you have reached your out-of-pocket max, then the rest of your covered services may be covered in full up to the allowed amount or usual, customary, and reasonable (UCR) charge determined by your insurance company. In this example, the out of pocket max isn’t reached until the 98th session in a given plan year — assuming you see a therapist weekly, it is unlikely you would hit this OOP Max based on psychotherapy sessions alone, but other in-network health services will count towards this OOP Max as the year goes on.

Using the Mind and Match estimator, you can see an estimate of your session-by-session cost under “Cost to You” by dragging the slider at the bottom to see your estimated cost of future sessions.

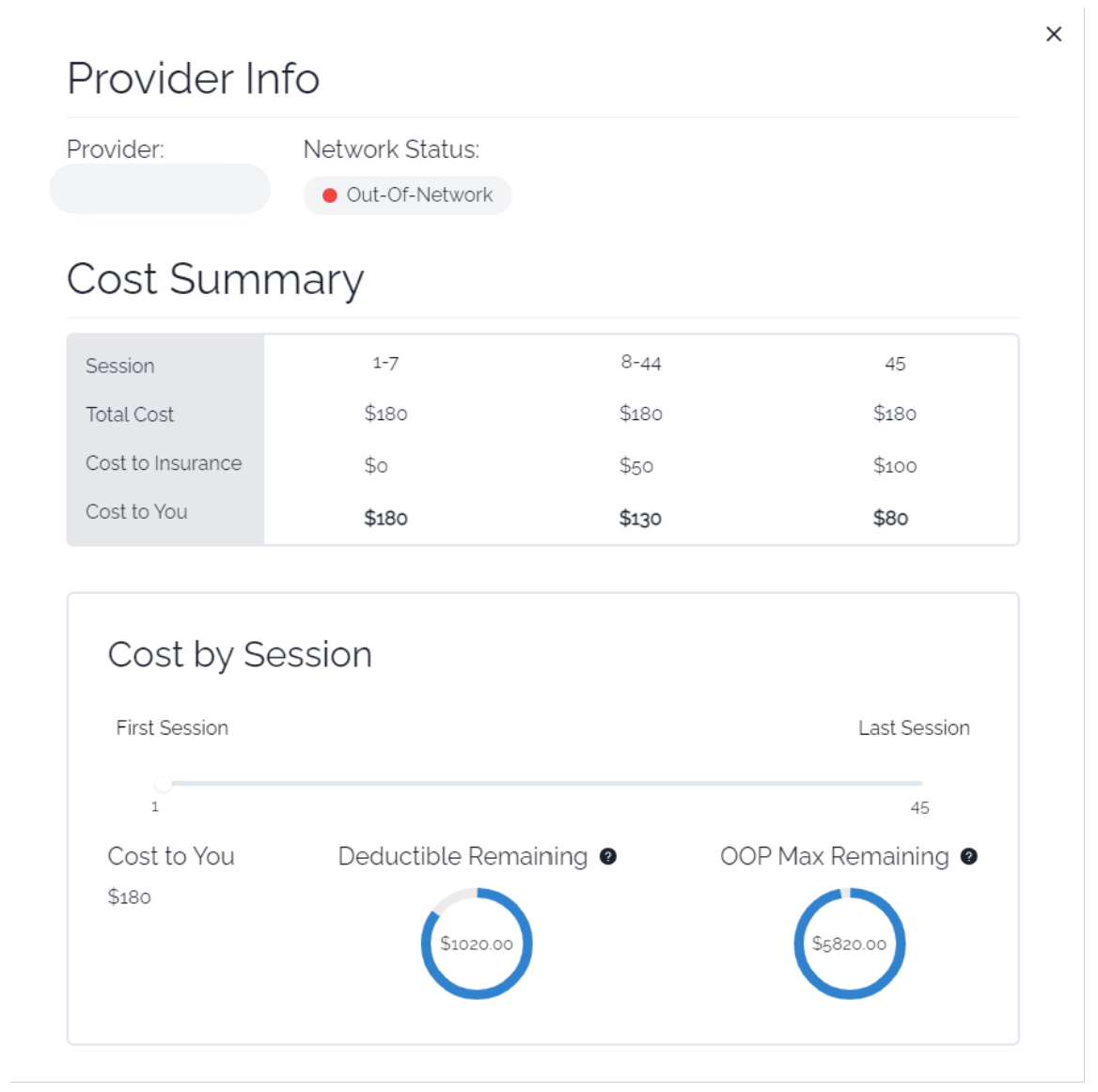

Insurance Status: Out-of-Network

If a provider is out-of-network, this means that they are not contracted with your health insurance company or they may not accept insurance at all. There are many structural reasons why some providers choose not to accept insurance (which are worth their own blog post!). However, even if the provider you want to see doesn’t take insurance, your health plan may reimburse you for some of the cost of each session — bringing down your out-of-pocket cost. These are often referred to as out-of-network benefits.

Typically, only Preferred Provider Organization (PPO) plans offer out-of-network benefits. However, even if you do have out of network benefits, you will be responsible for paying for the full cost of the session upfront, and then submitting for reimbursement from your health plan after the fact. You can ask your provider to generate a “superbill” for you each month that you can then submit to your insurance company, along with any required claim forms. Our Cost Estimate tool will estimate how much you may be eligible to be reimbursed for out-of-network visits (but you should always confirm with your health plan directly for exact amounts).

If your plan includes out of network benefits:

If you do have out of network benefits available, you may be responsible for a portion of the cost of each session, or a coinsurance. You will still need to pay for the full cost of the session upfront and submit for reimbursement, but you may be eligible to be reimbursed for a portion of the cost of each session. We’ve simplified this calculation to show you an estimate of the cost to you after submitting for reimbursement, but you should always confirm with your plan directly.

In the example above, this plan appears to have an out out-of-network deductible that must be met before the plan member is eligible for out of network benefits. This is why the patient is estimated to be responsible for the full $180 per session for the first 7 sessions, until they have contributed to the full deductible (Note: this assumes that this is the only individual contributing to plan spend). Once this patient has met their out of network deductible, their plan will begin covering a portion of the costs. In this example, this plan may pay $50 per session for the 8th — 44th session, until the out of network out of pocket maximum has been met. After that point, insurance will cover the cost of services up to the allowed amount or usual customary and reasonable (UCR) rate. We can see in this example that this plan will only cover approximately $100 of the $180 total session charge, so the remaining $80 will not be eligible to be reimbursed.

If your plan includes out of network benefits:

If you do not see any “cost to insurance” shown on your cost estimate, that likely means that you are not eligible to receive any reimbursement for out-of-network services. Therefore, you would be responsible for the full cost of each session.

We have simplified these calculations to show you an estimate of the cost to you over time, but you should always confirm with your plan directly.

Can you show me how the tool works?

We thought you’d never ask! Here’s a video with a demo of the tool.

Phew, that was a lot!

Thanks for hanging in there — we hope you find this helpful! As a reminder, our cost estimator is just an estimate of your expected costs. Contact your health plan directly to confirm details of your coverage and eligibility.

If you’re interested in diving even deeper into how to make mental healthcare as affordable as possible, we’ll be posting an extensive Affordability Guide soon! And as always, feel free to reach out to us with any questions — we’re here for you!